are inherited annuities tax free

Depending on the payout option selected the beneficiary of a tax-deferred annuity will be taxed differently on the income received. Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

Offset Taxes On Inherited Iras With This Annuity Annuity Inherited Ira Ira

So the person who inherited the annuity can receive a guaranteed lifetime that will also spread out the tax liability.

. Typically all inheritable qualified annuities usually IRA. If you have inherited your spouses annuity you can choose to transfer the annuity contract into your name. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds.

Inherited Annuity Tax Implications Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account. If a non-qualified annuity is annuitized then a portion of the. Inherited annuities are taxable as income.

Depending on the type of annuity the tax will have to be paid on the lump sum received or on the regular fixed. How To Pass Money To Heirs Tax-Free. A non-qualified annuity is an investment purchased outside of a work-related retirement plan using after-tax dollars.

The income from an inherited annuity is taxed. Learn some startling facts. When a person inherits an annuity the gains stay with the policy.

Ad Learn More about How Annuities Work from Fidelity. These annuities have already been subject to income tax however any. Ad Americas 1 Independently Rated Source for Annuities.

The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded with money that was already subject to taxes will still not be taxed. If a beneficiary takes the money over time no taxes are owed until the annuity is cashed in. To avoid taxes on an inheritance for your beneficiaries utilize a deferred annuity or a life insurance policy.

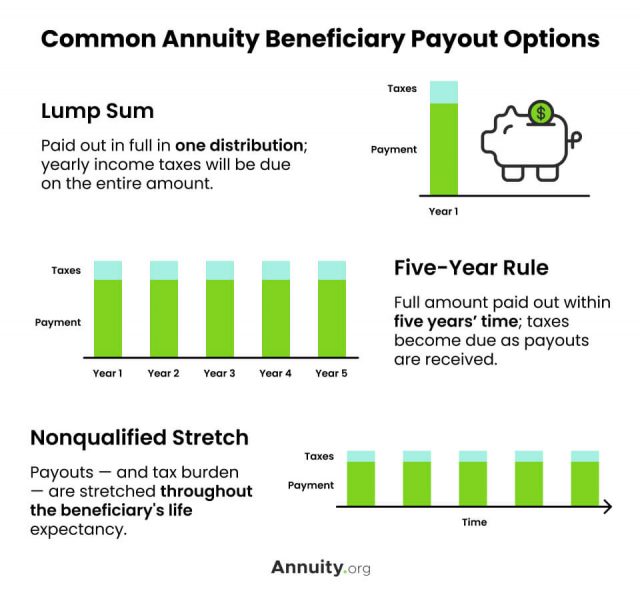

Learn why annuities may not be a prudent investment for 500000 retirement portfolios. The beneficiary of a tax-deferred annuity may choose from several payout options which will determine how the income benefit will be taxed. As a result inherited annuities are subject to tax.

The earnings are taxable over the life of the payments. Ad Learn More about How Annuities Work from Fidelity. Ad Annuities are often complex retirement investment products.

IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. Ad Annuities are often complex retirement investment products. Learn some startling facts.

Get Personalized Rates from Our Database of Over 40 A Rated Annuity Providers. Tax-deferred annuity beneficiaries can pick from a variety of payment alternatives that will affect how the. By The Money Farm Team.

Doing so allows you to keep the same options as the original owner.

Pass Money To Heirs Tax Free How To Avoid Taxes On Inheritance

Annuity Beneficiaries Inherited Annuities Death

Annuity Beneficiaries Inheriting An Annuity After Death

Inherited Non Qualified Annuities For Spouses Non Spouses And Trusts

Inherited Annuity Tax Guide For Beneficiaries

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

We Have Long Term Care Annuities That Double Or Triple Your Client S Premium For A Tax Free Long Term Care Benefit Annuity Retirement Planning Long Term Care